A Comprehensive Guide to Just How Credit Score Repair Service Can Transform Your Debt Score

Comprehending the details of credit repair is essential for anyone looking for to improve their monetary standing - Credit Repair. By dealing with issues such as settlement background and credit history utilization, people can take aggressive steps towards boosting their credit scores. The procedure is typically stuffed with false impressions and possible pitfalls that can hinder progression. This guide will light up the vital techniques and considerations essential for successful credit score repair, eventually revealing exactly how these efforts can cause extra beneficial monetary chances. What continues to be to be checked out are the certain activities that can establish one on the course to a more robust credit scores profile.

Comprehending Credit Rating

Understanding credit history is necessary for anybody looking for to boost their monetary health and accessibility far better borrowing options. A credit rating is a mathematical depiction of a person's creditworthiness, generally varying from 300 to 850. This rating is created based on the info consisted of in an individual's credit rating report, that includes their debt history, arrearages, settlement background, and types of credit rating accounts.

Lenders utilize credit rating to evaluate the danger related to lending cash or prolonging debt. Greater scores show lower danger, frequently leading to much more desirable lending terms, such as reduced rate of interest rates and greater credit line. Conversely, reduced credit scores can cause higher rates of interest or denial of credit rating completely.

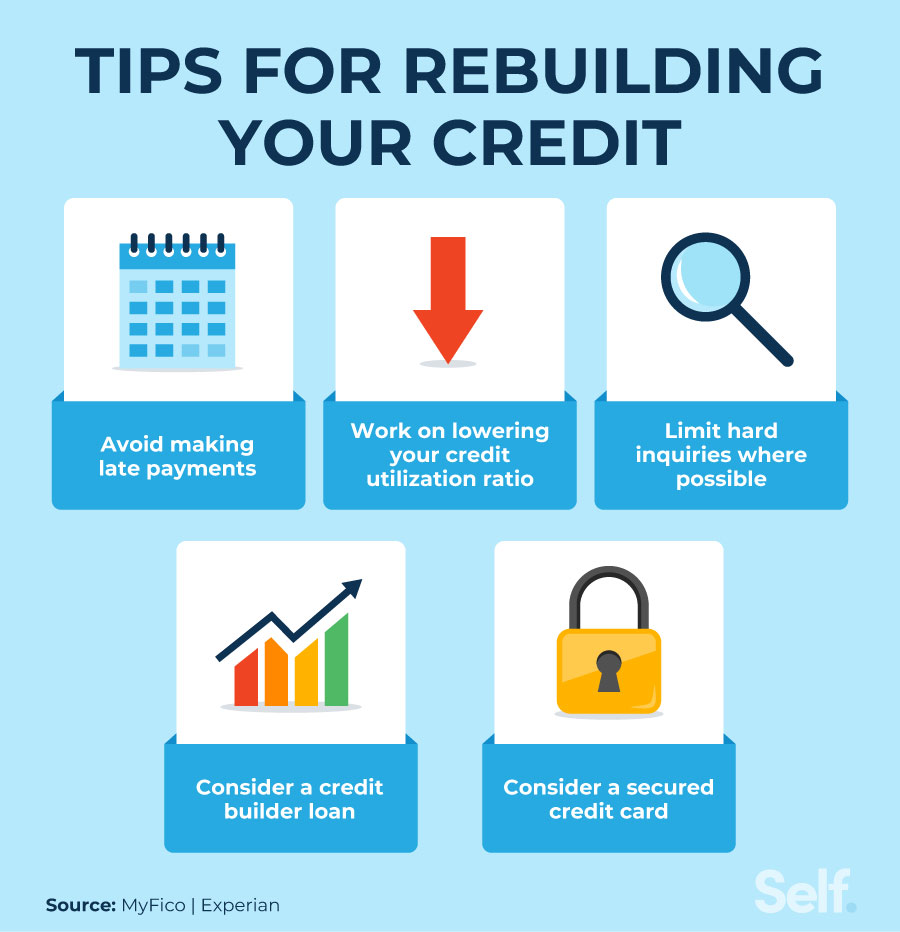

A number of elements affect credit rating, including repayment background, which represents roughly 35% of ball game, adhered to by credit score utilization (30%), length of credit report (15%), types of credit in operation (10%), and new credit queries (10%) Comprehending these factors can equip individuals to take actionable steps to enhance their ratings, inevitably improving their financial chances and stability. Credit Repair.

Typical Credit Report Issues

Many individuals face usual credit report problems that can prevent their economic development and influence their credit history. One prevalent concern is late payments, which can substantially harm credit rating scores. Even a solitary late settlement can stay on a debt record for numerous years, influencing future borrowing capacity.

Identity burglary is one more serious issue, possibly bring about illegal accounts showing up on one's debt report. Such situations can be testing to correct and might call for significant initiative to clear one's name. In addition, mistakes in credit report reports, whether because of clerical errors or outdated information, can misrepresent a person's credit reliability. Resolving these typical credit concerns is vital to improving economic health and establishing a strong debt account.

The Credit Scores Repair Work Process

Although credit scores fixing can appear daunting, it is a systematic procedure that people can embark on to enhance their credit report and correct inaccuracies on their credit records. The very first action why not look here entails acquiring a copy of your credit score record from the three significant credit rating bureaus: Experian, TransUnion, and Equifax. Review these reports carefully for inconsistencies or errors, such as incorrect account information or out-of-date info.

As soon as mistakes are determined, the next step is to dispute these errors. This can be done by calling the credit score bureaus directly, supplying documents that supports your claim. The bureaus are needed to check out disagreements within one month.

Maintaining a regular settlement history and managing credit report utilization is also critical during this process. Monitoring your credit scores frequently ensures ongoing precision and helps track improvements over time, reinforcing the effectiveness of your credit history fixing efforts. Credit Repair.

Advantages of Credit Report Fixing

The benefits of credit history repair prolong much beyond simply enhancing one's credit history; they can substantially affect financial stability and chances. By resolving inaccuracies and negative items on a credit rating record, people can improve their credit reliability, making them more attractive to lenders and financial establishments. This renovation commonly causes far better rate of interest on finances, reduced costs for insurance coverage, and boosted opportunities of authorization for charge card and home loans.

Moreover, debt repair service can facilitate access to essential services that need a credit report check, such as renting a home or obtaining an energy solution. More about the author With a healthier credit report account, individuals may experience raised confidence in their monetary choices, allowing them to make bigger purchases or financial investments that were previously out of reach.

Along with tangible economic benefits, credit rating repair work promotes a sense of empowerment. Individuals take control of their economic future by actively handling their credit scores, leading to even more informed selections and greater economic literacy. Overall, the benefits of credit score repair work add to a more steady monetary landscape, ultimately advertising lasting financial development and personal success.

Picking a Credit Report Repair Work Service

Choosing a credit repair work solution requires careful factor to consider to ensure that individuals get the support they require to boost their monetary standing. Begin by looking into potential firms, concentrating on those with favorable client reviews and a tested record of success. Transparency is vital; a respectable service must plainly outline their processes, timelines, and costs upfront.

Following, confirm that the credit fixing solution complies with the Credit Fixing Organizations Act (CROA) This federal regulation safeguards customers from misleading techniques and sets standards for debt repair service solutions. Avoid firms that additional reading make unrealistic assurances, such as assuring a particular rating rise or declaring they can get rid of all unfavorable items from your report.

Additionally, think about the level of client support used. A good credit repair work service ought to offer customized assistance, allowing you to ask concerns and obtain prompt updates on your development. Search for services that offer a thorough analysis of your credit scores report and create a personalized method tailored to your certain situation.

Eventually, picking the ideal credit scores repair service can bring about significant renovations in your credit history, equipping you to take control of your financial future.

Verdict

To conclude, efficient credit repair work approaches can considerably improve credit report scores by dealing with usual concerns such as late payments and errors. A comprehensive understanding of credit history elements, incorporated with the engagement of reliable credit report repair work solutions, facilitates the settlement of adverse items and recurring progress monitoring. Eventually, the effective enhancement of credit rating not just leads to better loan terms however likewise cultivates greater monetary possibilities and security, emphasizing the relevance of proactive credit rating monitoring.

By resolving issues such as payment history and credit scores use, people can take aggressive steps towards improving their credit history scores.Lenders utilize credit history ratings to examine the risk linked with lending cash or extending credit score.Another regular problem is high credit report use, defined as the proportion of existing credit rating card balances to complete readily available credit report.Although credit rating repair service can appear difficult, it is an organized procedure that individuals can carry out to enhance their credit scores and remedy errors on their credit rating reports.Next, confirm that the credit repair service complies with the Credit score Fixing Organizations Act (CROA)